Medicine’s Dirty Little Secret – Part 2

This is Part 2 in my “Dirty Little Secret” blog series, inspired by this article on NPR which featured Dani Yuengling, a woman who lives in Conway, SC, who received an unexpected bill for a breast biopsy that she had done at Grand Strand Medical Center. This half of my blog will focus on how true transparency in medicine works and discusses how transparency is a guiding principle at Noreta Family Medicine, a Direct Primary Care office in Columbia, SC.

Health insurance companies complicate the pricing of medical expenses. In my mind, medical pricing should work like pricing does in retail stores. For example, suppose that you go to the store to buy a couch. You can see the price of the couch and have a range of options to choose from at varying price points. Unfortunately, medical pricing does not work like that – you don’t know the prices up front and you don’t have choices. Secret payment rates are negotiated between hospital systems and insurance companies and there is zero transparency for you as the consumer/patient with the insurance policy. Go ahead and try it – Call up your insurance company and ask for a list of negotiated prices with Prisma, MUSC or Lexington Hospitals. (If you do this, please let me know what they say!!)

To go back to the furniture store analogy, you can go to a different furniture store to buy your couch if you’re not happy at the first store. However, unlike in the retail world, you almost never have a choice of the insurance company you can sign up with. Yes, you may have an option or two for the type of plan you will choose, but not the actual insurance company. The company you work for makes this choice for you. The lack of ability to choose your insurance company allows for prices to increase instead of decrease, like they would if there was a true competitive environment between insurance companies. Once a company signs on the dotted line, they are locked in for at least a year!

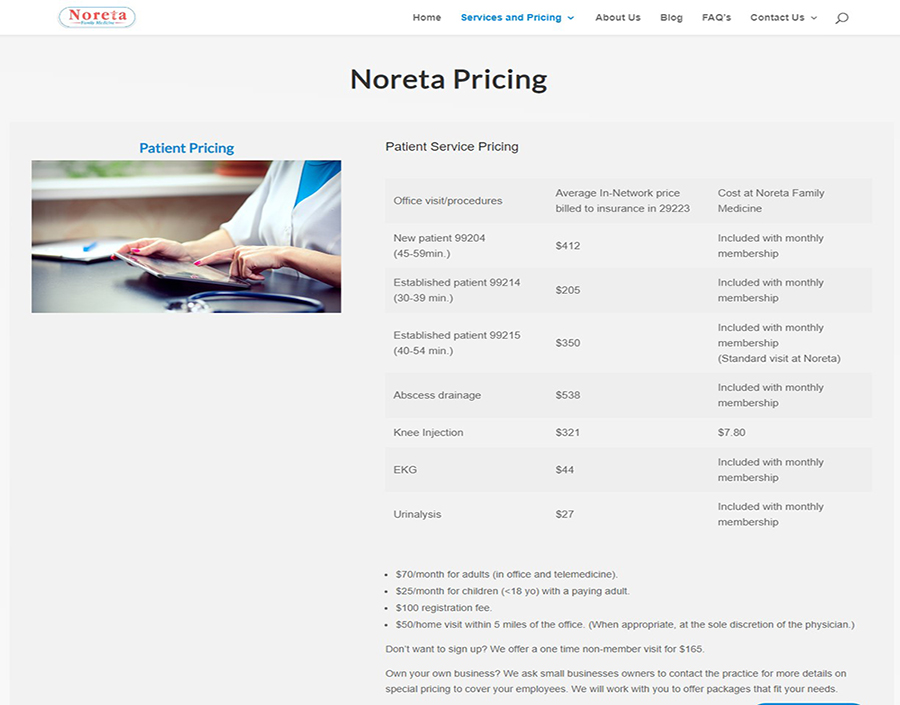

Don’t despair! The good news is that pricing at Noreta works like the pricing in the furniture store. You know what your costs are up front, so you can budget for the expenses. To add to the good news, the NPR article recommends that patients “…who have a high-deductible insurance plan should consider paying cash prices for certain procedures and not involving their insurance company at all.” Bingo! Let’s expand that to include primary care services because primary care services can also be affordable without using insurance. Don’t take my word for it. Here’s what the article says “It’s not uncommon for uninsured patients — or any patient willing to pay a cash price — to be charged far less for a procedure than patients with health insurance. For the nearly 30% of American workers with high-deductible plans, like Yuengling, that means using insurance can lead to a far bigger expense than if they had been uninsured or just pulled out a credit card to pay in advance.”

Ah yes, we have exposed the dirty little secret of medicine once again – paying without using health insurance drives down prices! Paying cash is what allows Noreta Family Medicine’s cholesterol panel to cost $2.50 and some medicines to cost as little as $0.01 per pill. Cutting out the insurance middle man cuts the need to increase prices in order to pay for administration. Cutting out the middle man simplifies and lowers costs for everyone involved, allows for transparency, and is the reason I opened a Direct Primary Care practice in Columbia, SC!

Melissa Boylan MD, FAAFP

Family Physician and Owner of Noreta Family Medicine

NoretaFamilyMed.com